When customers face urgent situations, they expect clear answers fast.

Imagine a 3 AM call from a homeowner whose basement is flooding.

They want to know if their policy covers a burst pipe or groundwater seepage. But most service reps must search through long documents, ask supervisors, or jump between systems.

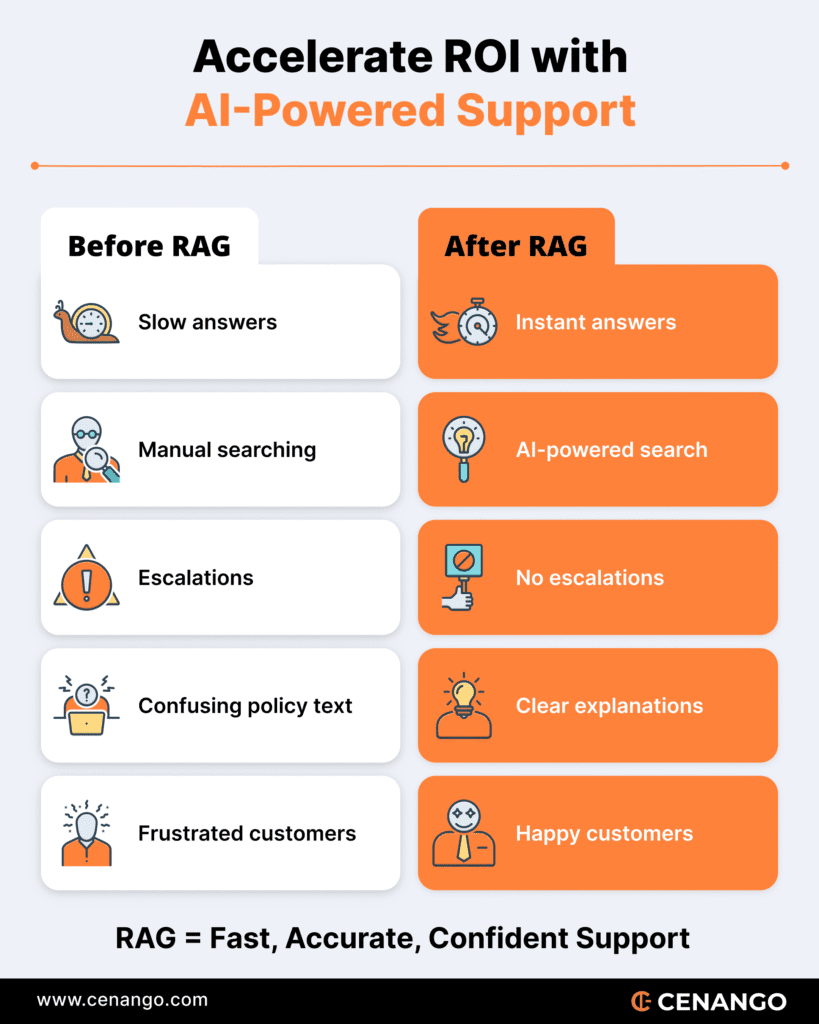

This leads to long wait times and frustrated customers.

Modern rag solutions (Retrieval-Augmented Generation systems) change this.

They help service teams answer complex policy questions in seconds, using verified information from your own documents.

No guessing. No confusion. Just accurate, real-time support.

Why RAG Solutions Solve the Complex Product Problem

Insurance policies contain hundreds of clauses, scenarios, and exceptions.

Reps often face two bad options: escalate the call or search through massive documents and legacy tools. Both slow the customer experience and create compliance risks.

RAG solutions fix this by combining accurate information retrieval with AI language understanding. Instead of scanning PDFs, the system finds the exact clauses that apply to the customer’s situation.

How RAG Solutions Deliver Better Answers

- Context-aware search: The system understands intent and retrieves the right policy details.

- Verified citations: Every answer links to the exact document section.

Always up to date: RAG systems use your current documentation, so reps never rely on outdated data.

How It Works Without Technical Jargon

RAG solutions organize your documents, retrieve what matters, and answer questions in plain language.

Reps ask a question the way they would ask a colleague, and the system returns accurate, source-backed information instantly.

Real-World Impact of RAG Solutions

RAG systems do more than speed up support—they transform outcomes:

- 45–87% faster resolution times

- 20–30% higher first-call resolution rates

- Consistent and compliant answers across all reps

- Lower training time for new hires

- Up to 95% improvement in customer satisfaction

Advanced rag solutions also anticipate the next steps in a call—coverage limits, exclusions, documentation needed, and more—so reps are always prepared.

What Makes RAG Solutions Actually Work

Not all platforms deliver the same results. The best rag solutions are built on:

- Complete and high-quality internal data

- Deep understanding of insurance terminology

- Integration with policy systems, CRM, and claims tools

- Continuous updates as products and regulations change

These systems empower service reps instead of replacing them. RAG becomes the intelligent assistant that removes the slow, manual work of searching for information.

Getting Started With RAG Solutions

A successful rollout begins with a focused pilot:

- Select one product line or common query type

- Build a structured knowledge base

- Train a small group of reps

- Measure results

- Expand as performance improves

Many organizations start with high-escalation products or common pain points that drive callbacks and customer churn.

Why RAG Solutions Are the Future of First-Call Resolution

In insurance, fast and accurate answers build trust. Customers leave after one bad experience, and losing them is far more expensive than keeping them.

Rag solutions give reps the ability to answer complex questions confidently, with information backed by your actual policy documents.

Companies using these systems already report:

- 40–87% lower resolution times

- 15–36 point increases in satisfaction scores

- 20–40% reductions in service costs

The technology is proven. The benefits are clear. The real question is whether you will adopt it before your competitors do.

A customer with a complex claim is calling right now. With rag solutions, your reps can give the right answer the first time—accurately, instantly, and confidently.

Ready to boost your first-call resolution? Explore how RAG solutions can be customized for your policies, products, and customer needs.