Your Complete Implementation Guide

Banking is changing fast. Customers want instant service at any hour. They expect personalized help through simple conversations. Meanwhile, banks must protect sensitive data and meet strict regulations. Secure conversational AI for banking solves this challenge perfectly.

This technology transforms how banks serve customers. It delivers speed and convenience without compromising security. Let’s explore how it works and why your institution needs it now.

Why Banks Need Secure Conversational AI Today

The shift to digital banking is accelerating. 73% of global banks now deploy at least one AI-powered chatbot in customer-facing operations in 2025 .88% of US-based Tier 1 banks have integrated AI chatbots across mobile and desktop platforms by 2025

These numbers tell a clear story. Your customers have moved online. They expect immediate answers to their questions. They want help managing accounts at midnight just as easily as noon.

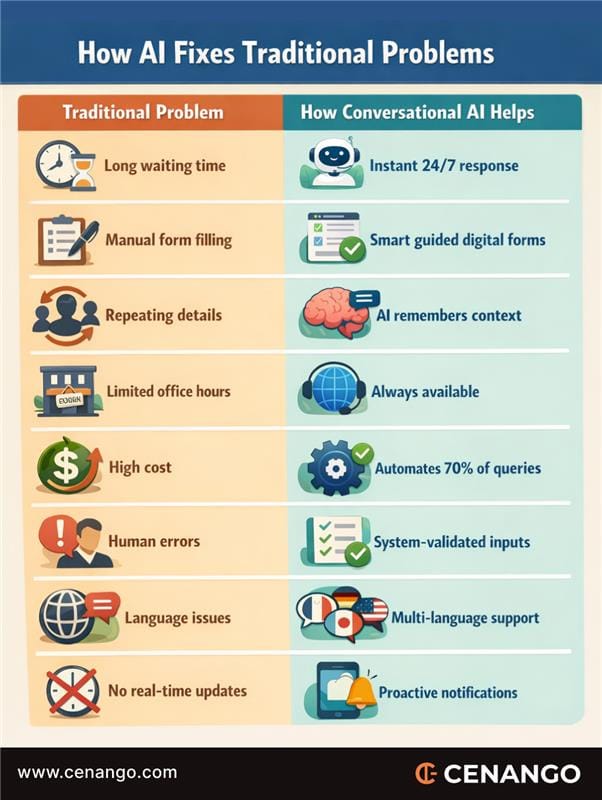

Traditional customer service can’t meet these demands. Call centers have limited hours. Wait times frustrate customers. Costs keep rising.

Secure conversational AI for banking changes everything. It provides instant responses 24/7. It handles thousands of conversations simultaneously. Most importantly, it keeps customer data protected through every interaction.

The Business Impact Is Massive

The financial benefits are hard to ignore. Conversational AI delivers real cost savings.

Banks saved an estimated $7.3 billion globally in 2025 due to chatbot-related efficiencies The economics are compelling. When compared to human agent customer service models, chatbots deliver $8 billion per annum in cost savings, approximately $0.70 saved per customer interaction

Banks can save $0.50 to $0.70 per interaction with AI compared to traditional methods. This creates massive opportunities for financial institutions handling millions of customer interactions yearly.

But money isn’t the only benefit. Banks using AI-driven personalization report a 12.3% higher customer retention rate compared to those relying solely on traditional methods. Banks with strong omnichannel execution see a 20% increase in customer satisfaction

Chatbots helped reduce inbound call volumes by 42% in 2025 This frees human agents for complex cases. They focus on relationship building instead of password resets.

Bank of America's Erica

Bank of America’s virtual assistant Erica demonstrates the power of secure conversational AI for banking. Erica has surpassed 3 billion client interactions and now averages more than 58 million interactions per month. Nearly 50 million users have used Erica since its 2018 launch

The results speak volumes. More than 98% of clients get answers they need from Erica within 44 seconds on average Bank of America trains Erica to answer client questions with a library of more than 700 responses

Holly O’Neill, president of consumer, retail and preferred lines of business, says the two million daily consumer interactions with Erica save the bank the equivalent of 11,000 staffers’ daily work. Erica now solves 98% of its customer inquiries without further human interaction

Security Comes First in Banking AI

Banking AI faces unique challenges. Every conversation involves sensitive financial data. Regulations like GDPR, CCPA, and PCI DSS must be followed perfectly. Customer trust is everything.

Modern secure conversational AI for banking uses multiple protection layers. End-to-end encryption guards every message. Customer data gets tokenized. The AI works with secure references, not actual account numbers.

Authentication goes beyond passwords. Biometric verification confirms identities. Multi-factor authentication adds extra security. Behavioral analysis detects unusual patterns automatically.

Fraud detection runs continuously in the background. 91% of U.S. financial institutions now use AI-powered conversational systems that can detect unusual transaction patterns, verify customer identities in real time, and send alerts before fraud occurs

Compliance is built into the system design. Audit trails generate automatically. Data retention follows regulatory requirements. Privacy controls give customers full transparency and control.

Real Applications Transforming Banking Operations

- Account Management Made Easy Customers check balances through natural conversation. They review transactions and transfer funds. The AI understands context and remembers preferences.AI chatbots now handle 70-85% of inbound queries for retail banks in North America in 2025, with resolution accuracy rates reaching 91% CoinLaw. Complex requests work smoothly without human intervention.

- Faster Loan Processing AI guides customers through applications. It answers questions about terms and rates. Preliminary approvals happen in minutes using real-time credit checks.What took days now completes in a single session. Regulatory compliance stays intact throughout.

- Proactive Fraud Prevention Suspicious activity triggers immediate outreach. The AI contacts customers via SMS, app notifications, or calls. Transactions get verified instantly.This rapid response prevents fraud effectively. Legitimate customers avoid frustrating false positives.

- Personal Financial Guidance The AI analyzes spending patterns and goals. It provides tailored savings recommendations. Budget strategies match individual needs.70% of financial services executives believe AI will directly contribute to revenue growth in the coming years, driven by better-informed strategic decisions

How Leading Banks Deploy AI Successfully

- Start Small and Focused Begin with a pilot program. Choose one specific use case like balance inquiries or password resets. This proves value quickly with minimal risk.Early wins make expansion easier. Stakeholders see benefits firsthand.

- Invest in Quality Training Data Your AI is only as good as its training. Include diverse customer interactions. Add edge cases and industry terminology.Banking customers span all demographics and skill levels. Your AI must communicate effectively with everyone.

- Design Smooth Handoffs 88% of chatbots in 2025 can now escalate to a human agent with full conversation context retained Some situations need human judgment. Create seamless escalation paths.Human agents should receive full conversation context. Customers never repeat information.

- Monitor Performance Constantly Track traditional metrics like response time and resolution rate. Also measure security indicators. Authentication success rates matter. So do fraud prevention statistics.On average, chatbot integration lowered customer service operating costs by 29% per bank in 2025 This data proves ROI while identifying improvement opportunities.

Implementation Steps for Your Institution

Ready to deploy secure conversational AI for banking? Follow this roadmap:

Step 1: Audit Current Pain Points

Identify where conversation volume is highest. Note where resolution times run longest. These represent maximum impact opportunities.

Step 2: Choose the Right Platform

Select a vendor with banking expertise. Verify security certifications. Confirm regulatory compliance features.

The platform should integrate with legacy systems. APIs and middleware bridge technology gaps.

Step 3: Define Use Cases Clearly

Start with high-volume, routine inquiries. Balance checks, transaction history, and basic troubleshooting work well.

Expand to complex scenarios gradually. Learn and improve continuously.

Step 4: Test Thoroughly

Run extensive security testing before launch. Verify authentication systems work flawlessly. Confirm data encryption at all levels.

Test with diverse user groups. Include various demographics and technical skill levels.

Step 5: Launch and Learn

Deploy to a limited user segment first. Monitor closely and gather feedback. Refine based on real-world usage.

Scale gradually as confidence grows. Update the knowledge base regularly with new products and policies.

The Future of Banking Conversations

Technology continues advancing rapidly. The voice banking market was valued at $1.64B in 2024 and is expected to grow at a CAGR of 10.81%, reaching $3.73B by 2032. Voice-first banking is emerging. Customers manage finances through smart speakers and voice assistants.

Predictive AI will anticipate needs before customers ask. Proactive solutions address financial challenges automatically.

Open banking APIs enable holistic financial management. Your AI assistant could optimize portfolios across multiple institutions. It moves money to maximize interest or minimize fees through simple conversation.

Natural language processing keeps improving. Robotic responses are disappearing. Conversations feel genuinely helpful and surprisingly human-like.

The market is projected to grow from USD 13.2 billion in 2024 to USD 49.9 billion by 2030, reflecting a compound annual growth rate of 24.9%

Overcoming Common Concerns

Some customers remain skeptical about AI handling finances. Address this through transparency. Clearly communicate when they’re interacting with AI. Provide easy access to human agents.

Demonstrate value through superior service quality. Banks that are transparent see higher adoption rates. Trust scores improve significantly.

Integration with legacy systems seems daunting. Modern platforms are designed for this challenge. Robust APIs and middleware solutions bridge gaps. Complete system overhauls aren’t necessary.

Maintaining the human touch matters deeply. Banking is about relationships. Use AI to enhance, not replace, human connections. AI handles routine tasks. Staff focuses on complex problem-solving and relationship building.

Your Next Move

Secure conversational AI for banking isn’t optional anymore. It’s becoming essential for competitive survival. Your customers expect instant, personalized service. They demand security and convenience together.

The technology is proven. 73% of global banks now deploy at least one AI-powered chatbot in customer-facing operations in 2025 Customer satisfaction improves measurably. Cost savings are substantial.

Start by auditing your current service model. Identify high-volume interaction points. These represent your biggest opportunities.

Choose a security-first platform with banking expertise. Begin with focused pilots. Learn, iterate, and expand.

The banks winning tomorrow’s customers are building today’s AI capabilities. They’re delivering exceptional service at any scale. They’re doing it securely and compliantly.

Your customers are ready for this transformation. With proper security measures, you can deliver confidently. Protect what matters most—customer trust and financial wellbeing.

The future of banking speaks your customers’ language. Are you ready to join the conversation with secure conversational AI for banking?

Sources & References

- EMA.co (2025). “Conversational AI in Banking: Key Benefits & Future Trends”

- CoinLaw (July 2025). “Banking Chatbot Adoption Statistics 2025: Usage, Efficiency, etc.”

- ArticSledge (October 2025). “AI in Banking: Complete Guide (2025)”

- Consumer Financial Protection Bureau (2024). “Chatbots in Consumer Finance”

- Bank of America Press Releases (August 2025). “A Decade of AI Innovation: BofA’s Virtual Assistant Erica Surpasses 3 Billion Client Interactions”

- The Financial Brand (December 2025). “What Banks Can Learn from BofA’s Multi-Billion Dollar AI Bet”

- Acropolium (2025). “Conversational AI for Banking: Use Cases for 2025”

- Fortune Business Insights (2024). “Conversational AI Market Size, Share & Statistics [2025-2032]”