Insurance companies handle thousands of documents every week. Claims forms. Policy files. Medical records. Regulatory papers. All need checking.

Manual checking is slow. It costs too much. McKinsey found that smart document systems cut processing time by 30%. They also reduce costs by 20%. Manual work creates delays. Delays hurt profits. Delays upset customers.

RAG offers a better way. It helps you check documents faster. It’s more accurate. It keeps you compliant. Best of all, it works with what you have now.

What Is RAG?

RAG is an AI system. Here’s what it does:

- Finds information in your documents

- Understands it correctly

- Makes decisions based on your verified data Simple as that.

What you get:

✓ Reads your insurance documents

✓ Applies your rules

✓ Finds errors or missing data

✓ Keeps decisions accurate

It’s safer than chatbots. Why? It uses your verified knowledge. Not random internet data.

What Is RAG-as-a-Service?

You get all RAG benefits. Without these headaches:

- Building infrastructure

- Hiring data scientists

- Managing updates

- Maintaining servers

The provider handles everything. You just upload documents. Then start checking.

Key Benefits:

✓ Fast setup (weeks, not months)

✓ Lower cost than building your own

✓ Minimal IT work

✓ Works with your current systems

1. RAG Replaces Manual Document Checking

Your team spends hours reading documents. Studies show workers spend 1.8 hours daily just finding information. That’s time wasted. RAG checks documents in seconds.

Tasks RAG handles:

- Reading 100+ page policy files

- Checking coverage limits

- Validating sums insured

- Comparing document versions

- Verifying KYC compliance

- Finding archived documents

What RAG does:

✓ Reads every page

✓ Pulls out key values

✓ Finds mismatches fast

✓ Checks against your rules

✓ Creates audit trails

This removes human errors. It removes fatigue.

2. AI Catches Mistakes Before They Cost Money

Small errors create big losses. In the US, P&C fraud costs insurers $50 billion yearly. Claims leakage from errors costs billions more.

RAG checks every line in:

- Claims submissions

- ID and KYC files

- Medical reports

- Loss adjuster notes

- Policy documents

- Renewal papers

- Broker submissions

The AI never misses details. Studies show AI systems process claims with 80% accuracy. They learn from mistakes. They improve over time.

3. Stay Compliant With Changing Rules

Insurance regulations change often. Data privacy rules change. KYC requirements change. Claim timelines change.

Old systems can’t update fast. RAG can.

With RAG, you get:

✓ Automatic rule updates

✓ No old policy approvals

✓ Full audit trails

✓ Instant regulatory alignment

This reduces fines. It reduces audit failures.

4. Faster Work = Happier Customers

Speed matters. Accenture found that automation cuts handling time by 50%. It also improves accuracy by 30%. Some claims that took three hours now finish in minutes.

J.D. Power’s 2023 research proves speed matters. Claims settled in one week scored 30% higher in satisfaction.

Benefits you’ll see:

- More claims per day

- Smaller backlogs

- Faster underwriting

- Lower costs

- No overtime needed

Speed gives you an edge.

5. Stop Hidden Losses

Insurance fraud costs 10% of P&C payouts yearly. That’s about $50 billion in the US. In Europe, fake claims total €13 billion yearly. Nearly 10% of all payouts.

Manual checking misses fraud. RAG catches it by:

✓ Finding fraud signs

✓ Detecting fake documents

✓ Checking exclusions

✓ Verifying dates and signatures

✓ Ensuring all documents are submitted

Accenture reports that AI cuts false claim payouts by 25%.

Every check becomes thorough.

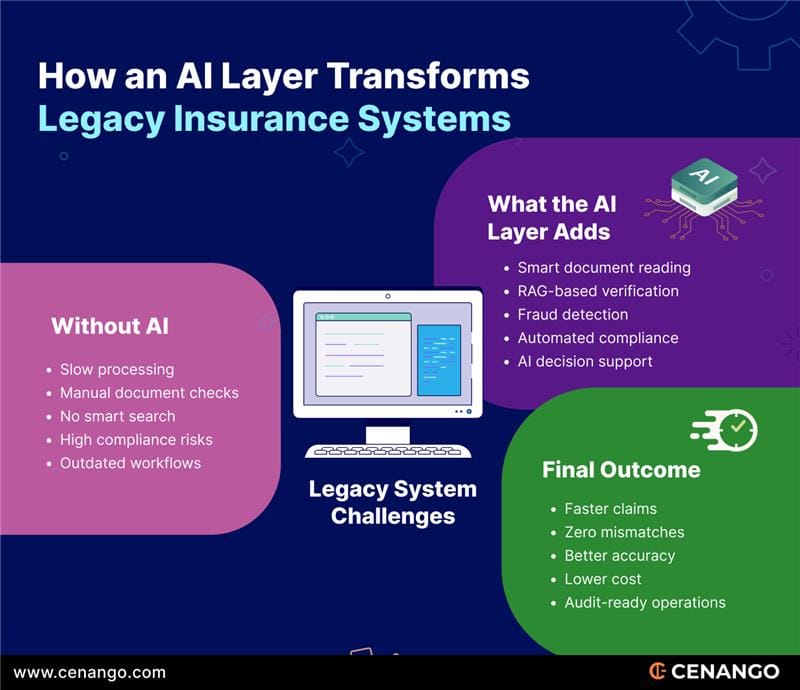

6. Upgrade Without Replacing Your Systems

No matter what you use today, RAG adds intelligence. No replacement needed.

It connects through:

- APIs

- Secure links

- Shared drives

- Your CRM systems

Your core systems stay. RAG makes them smarter.

Already Have Software? RAG Still Helps

Most insurers have admin systems. Most have claim workflows. But these systems can’t: ✗ Read full PDFs ✗ Compare versions ✗ Understand limits ✗ Find mismatches ✗ Update rules fast This is the gap. RAG fills it. No IT disruption. That’s why RAG-as-a-Service works best. It upgrades your work now.The Money Makes Sense

Cost Savings:

- Cut costs from $40-60 per claim to under $20

- Reduce expenses by 15-25% in two years

Protect Revenue:

- Stop fraud losses (10% of payouts)

- Prevent leakage from errors

Speed Edge:

- Process claims 50% faster

- Improve satisfaction by 30%

- Deploy in 4-8 weeks vs. 12-18 months

Bottom Line

RAG changes insurance work. Document checking becomes: ✓ 50% faster ✓ 30% more accurate

✓ Fully compliant

✓ Ready for audits

✓ Easy to scale

✓ Cost-efficient

Manual checking slows you down. RAG speeds you up. It gives you an edge.

Ready to Transform Your Work?

Cenango delivers RAG-as-a-Service for insurance companies.

We have 23+ years of software experience. We know insurance challenges. We understand healthcare, finance, and compliance needs.

Why Choose Cenango RAG:

Fast Setup: Go live in 4-8 weeks. Works with your systems now.

Proven Results: 80%+ accuracy. Continuous learning. Our clients report:

- 40-60% faster processing

- 25-35% less claims leakage

- Better customer satisfaction

Full Compliance: HIPAA-ready. Complete audit trails.

No IT Burden: No infrastructure. No data scientists. No complex projects.

Your Problems, Solved:

✓ Document backlogs? Process 10x more with the same team.

✓ Fraud and errors? Catch issues before they cost money.

✓ Compliance struggles? Automatic updates keep you aligned.

✓ High costs? Cut processing costs by 50% or more.

✓ Slow claims? Make decisions in minutes, not days.

Get Started Now

Free Consultation Talk about your document challenges. See how Cenango RAG transforms your work.

Calculate Your Savings Use our ROI calculator. See exactly how much you’ll save.

Contact Cenango:

📧 Email: info@cenango.com

🌐 Web: www.cenango.com

📞 Phone: 1 (888) 850-4650

Locations: Miami, Florida (HQ) | Dallas, Texas | Colombo, Sri Lanka

Don’t let manual work slow you down. Join smart insurance companies already using RAG.

The future is here. Will you lead or follow?

Contact Cenango today to start your change.