Your institution’s loan processing system was built for a different era. Multi-day approval cycles. Manual document verification. Compliance officers buried in paperwork. Meanwhile, your applicants expect Amazon-level service, and your competitors may already be moving faster.

RAG pipelines, Retrieval-Augmented Generation technology, are fundamentally changing this equation. Financial institutions implementing these intelligent systems report 60% reductions in processing cycles, dramatic improvements in accuracy, and measurable competitive advantages.

The Hidden Costs of Traditional Loan Processing

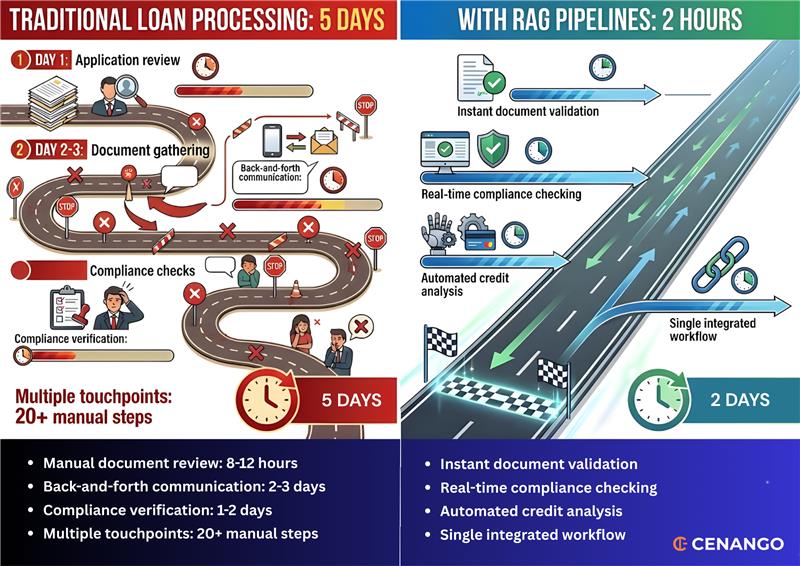

Traditional loan application processing involves significant operational drain. Manual data entry consumes 5-15 minutes per document. Verification takes an additional 3-8 minutes. Exception handling can require 10-30 minutes per case. Across thousands of applications, these minutes translate to substantial costs and frustrated applicants stuck in limbo.

The typical personal loan journey spans one to seven business days with traditional banks—assuming no complications. Each application touches multiple systems that don’t communicate. Context-switching between applications reduces officer productivity. Documents arrive in various formats, requiring manual validation. Compliance checking against evolving regulations happens sequentially, not systematically.

This isn’t just inefficient—it’s creating strategic vulnerability.

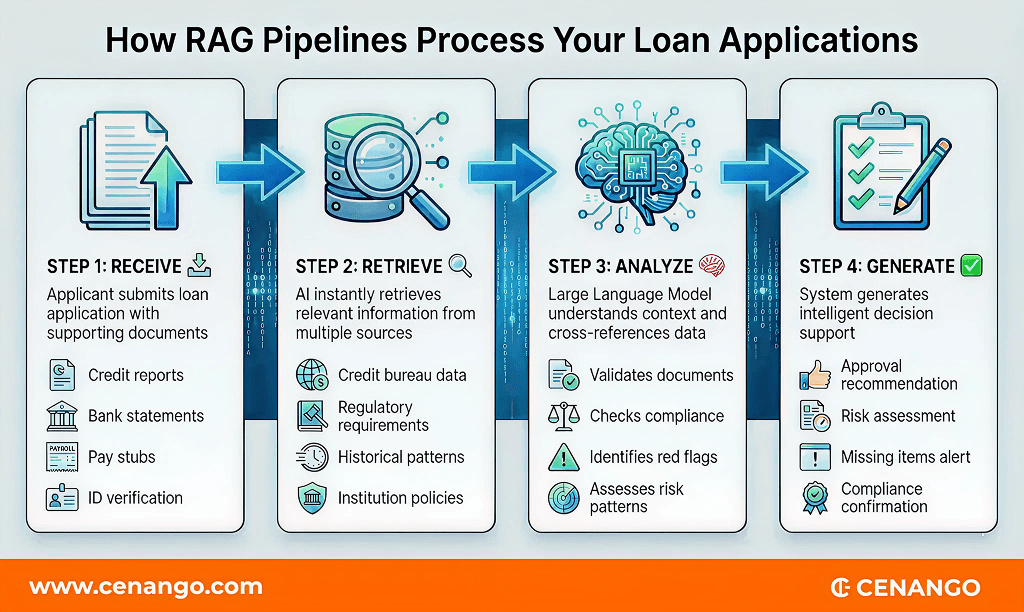

What Makes RAG Pipelines Different

Unlike rule-based automation or simple OCR tools, RAG pipelines combine large language models with real-time information retrieval. Think of it as having a loan officer who accesses any document instantly, recalls every regulation perfectly, processes information at machine speed, and maintains nuanced understanding for complex decisions—24/7 without fatigue.

The technology doesn’t just extract data. It understands context. When an applicant shows a credit dip three years ago, intelligent RAG pipelines correlate that event with information in supporting documents, distinguishing between concerning patterns and resolved one-time hardships.

Three Ways RAG Pipelines Transform Loan Operations

1: Automated Credit Analysis and Document Validation

The moment applications arrive, RAG pipelines retrieve comprehensive credit histories, analyze patterns across multiple bureaus, identify red flags, and cross-reference information with application data—simultaneously.

Document validation moves beyond simple presence checks. The system verifies authenticity, ensures completeness, cross-references consistency across documents, and extracts relevant data automatically. If a pay stub lists Company X while the employment letter mentions Company Y, the system flags this immediately rather than surfacing the discrepancy days later during manual review.

Applicants receive real-time feedback on missing or problematic documents within minutes, allowing immediate correction rather than losing days in the queue.

2: Dynamic Compliance Cross-Referencing

RAG pipelines excel at navigating complex regulatory frameworks. Lending compliance involves federal regulations, state-specific requirements, industry standards, institutional policies, and special program guidelines—often overlapping and sometimes conflicting.

These systems maintain updated knowledge of all relevant compliance frameworks and automatically cross-reference applications against applicable requirements. They understand that VA loans have different requirements than conventional mortgages, certain states mandate additional disclosures, and income verification standards vary by loan type.

When regulations change, RAG pipeline updates propagate instantly across all applications—no staff retraining or manual updates required.

3: Intelligent Risk Assessment

Beyond verification and compliance, RAG pipelines synthesize information from multiple sources to provide comprehensive risk profiles. They identify patterns that individual reviewers might miss, flag potential issues proactively, and provide loan officers with actionable insights rather than raw data.

Measurable Business Impact

Processing Speed

A short-term lender implementing AI-powered processing reduced loan approval times from 5 days to just 2 hours through integrated ID verification, OCR technology, and automated credit assessment. Financial institutions deploying RAG technology consistently report approximately 60% reductions in document review and approval cycles.

For personal loans, what traditionally required multiple business days can now be accomplished in hours for initial screening and document validation. Complex mortgage underwriting still requires appraisals and additional verification, but RAG dramatically accelerates the document processing and compliance phases.

Accuracy and Error Reduction

Human reviewers have limitations. Processing their 20th application of the day, even experienced officers make mistakes. Organizations implementing AI in financial operations report 60-80% reductions in error rates. Invoice processing—a similar document-intensive task—sees costs drop from $15-40 per item to $3-8 per item, demonstrating the scalability across financial operations.

Operational Efficiency

HSBC’s implementation of AI in fraud detection now detects 2-4 times more suspicious activity while reducing alert volumes by 60%, cutting manual review time significantly. JP Morgan Chase reports a 15-20% reduction in account validation rejection rates through AI-powered payment validation screening.

Organizations implementing AI-powered financial operations typically realize 60-80% reduction in direct processing costs, processing hours reduced from 250+ monthly to 60-85 hours, and 70% average productivity increases across finance teams.

Competitive Advantage

Speed and accuracy aren’t optional—they’re table stakes. When one lender provides preliminary approval in hours while competitors take days, the choice becomes obvious. Forward-thinking institutions implementing RAG pipelines report faster processing with 60% cycle reduction, higher application completion rates, improved customer satisfaction scores, and better regulatory compliance records.

Strategic Implementation

RAG pipelines don’t replace loan officers—they empower them. By automating routine verification and documentation tasks, these systems free officers to focus on relationship building, complex cases requiring judgment, and personalized applicant service. Approximately 80% of routine tasks become automated, allowing senior officers to tackle scenarios requiring expertise.

The Path Forward

RAG pipeline implementation represents more than operational improvement—it’s strategic positioning. As regulatory complexity increases and customer expectations continue rising, these systems offer a path to address both challenges simultaneously.

The transformation isn’t theoretical. Real financial institutions are already achieving these results. The technology is proven, the benefits are measurable, and early adopters are establishing competitive advantages.

For banking executives evaluating digital transformation priorities, RAG pipelines for loan processing deliver immediate ROI through reduced operational costs, faster customer service, and improved accuracy—while positioning your institution for future regulatory and market demands.

The question isn’t whether to implement intelligent loan processing powered by RAG pipelines. It’s whether you’ll lead this transformation or respond to competitors who moved first. In a market where hours matter and accuracy drives trust, the institutions deploying these systems now are redefining customer expectations for everyone.

Ready to Transform Your Loan Processing with RAG Pipelines?

Cenango specializes in implementing intelligent RAG pipeline solutions for financial institutions. Our proven systems deliver 60% faster processing cycles, dramatic error reductions, and measurable ROI—typically within 12-18 months.

We’ve helped lenders across the US reduce approval times from days to hours while improving accuracy and compliance. Our team understands the unique challenges facing banking executives and delivers tailored solutions that integrate seamlessly with your existing infrastructure.

Book a discovery meeting with our AI solutions team to explore how RAG pipelines can give your institution a competitive edge in today's fast-paced lending environment.